Increase in Negative Pricing Hours on the Day-Ahead Electricity Market in 2024

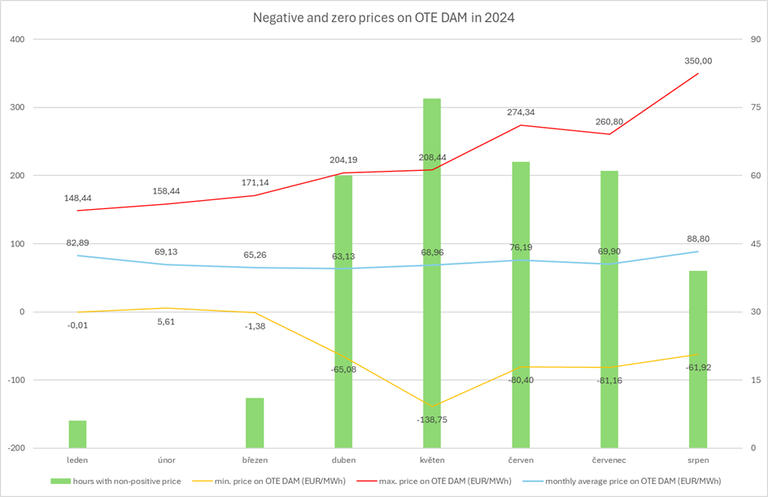

The development of trading on the day-ahead electricity market (DAM) organized by OTE, a.s. contributes to the price reduction. In the spring and summer months of 2024, there was an increase in trades at a negative price. This increases the number of hours when the customer does not pay for the consumption of electricity, but on the contrary gets paid, and thus its costs are reduced. Almost 50 days between April and August, electricity was traded at a negative price on the day-ahead market, which is almost three times as many cases as in the same period last year. The highest negative price achieved was - 138.75 EUR/MWh on 12.5. 2024.

The most hours with a negative price were during April to June. This confirms the fact that the production from photovoltaic power plants (PVE) is strongly influenced not only by the number of hours when the sun shines, but also by the outdoor temperature. The efficiency of PV production decreases with increasing temperature (in summer, during days with high temperatures, PV plants achieve lower efficiency than in spring or autumn).

“I welcome that OTE's short-term markets contribute to achieving lower prices and greater business opportunities. Negative prices and price volatility in general can motivate market participants to greater activities within the energy markets, implementation and development of accumulation and provision of flexibility on the consumption side as well," says Michal Puchel, Chairman of the Board of Directors of OTE.

Short-term electricity markets organized by OTE, a.s. successfully help the electricity market not only in situations where there is a shortage of electricity, but also in situations where there is a significant surplus of energy on the market due to weather conditions. As a result, trading on short-term markets organized by OTE contributes not only to consumers, but also to the reduction of energy procurement costs, allows traders to reduce imbalance costs and is a suitable tool for increasing supply reliability in times of surplus production from renewable energy sources (sun, wind). For the sake of interest, it is also important to mention the fact that when trading on the day-ahead electricity market, there are also hours in which the electricity price is zero. This occurred 26 times in the period from April to August 2024. Prices also develop in the intraday electricity markets organized by OTE in a similar way to the daily market.

The development of trading at negative prices on the day-ahead electricity market compared to the average price achieved on the day-ahead electricity market is shown in the following figure.

The press release in PDF format is available here.