SIDC

Contents:

Single intraday coupling ('SIDC') creates a single European cross-zonal intraday electricity market. In simple terms, buyers and sellers of energy (market participants) are able to work together across Europe to trade electricity continuously on the day the energy is needed. An integrated intraday market makes intraday trading more efficient across Europe by:

- promoting competition,

- increasing liquidity (i.e. increasing the ease with which energy can quickly be bought and sold without affecting its price),

- making it easier to share energy generation resources, and

- making it easier for market participants to allow for unexpected changes in consumption and outages.

As intermittent renewable production such as solar energy increases, market participants are becoming more interested in trading in the intraday markets. This is because it has become more challenging for market participants to be in balance (i.e. supplying the correct amount of energy) after the closing of the day-ahead market. Being balanced on the network closer to delivery time is beneficial both for market participants and power systems by, among other things, reducing the need for reserves and associated costs.

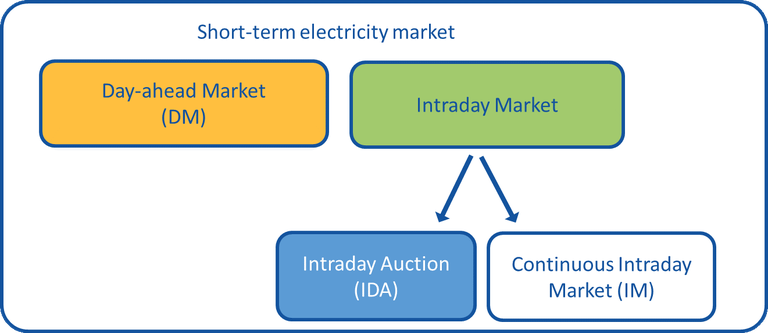

From June 13, 2024, the intraday market is divided into continuous intraday market ('IM') and intraday auctions ('IDA'), which complement the continuous intraday market.

Figure 1 – Intraday Market Division

Nominated electricity market operators and transmission system operators closely cooperate for the efficient and successful operation of the SIDC.

The parameters for intraday market trading are provided here.

The development of SIDC is crucial for all parties involved in the project. Below is a list of key future development steps aimed at expanding and improving the efficiency of SIDC:

- Intensive work is currently underway to enable the allocation of cross-border capacities for both continuous IM and IDAs based on Flow-Based calculation methods.

- Expanding SIDC to additional areas and new entities remains a priority.

- In the long-term, solutions considering losses on High-Voltage Direct Current (HVDC) cables are being contemplated.

Transition to 15 min. resolution on the intraday market

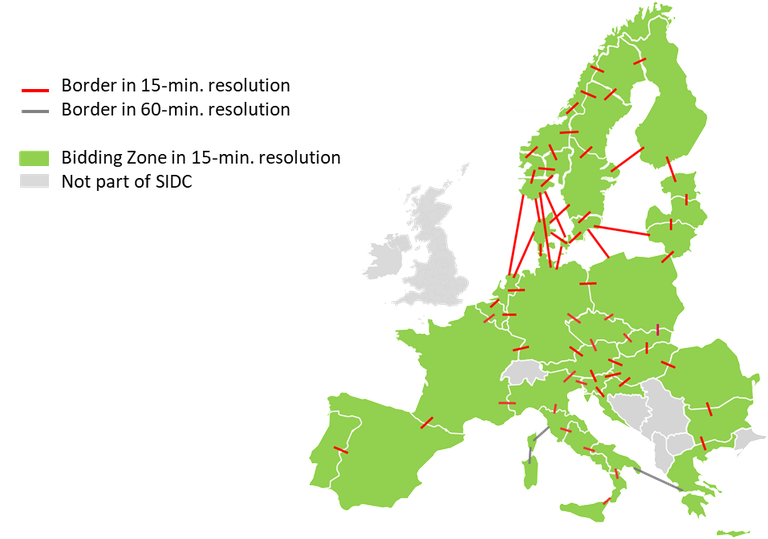

The transition to a 15-minute resolution on the intraday market (IM and IDA) took place within SIDC countries in waves during the years 2024-2025. The final currently valid status of the resolution of the borders and bidding zone is shown in the figure below, with the exception of GR (Greece) bidding zone that will only support 60-minute resolution orders until the introduction of 15-minute products on Day-ahead market. The borders IT-GR and & IT-SARD-IT CODC will remain in 60-minute resolution due to limitations of the relevant HVDC cables.

Figure 2 - Resolution of borders and bidding zones within SIDC

SIDC – Continuous Intraday Market (‘IM‘)

SIDC – Continuous Intraday Market is a joint initiative between Nominated Electricity Market Operators ('NEMOs') and Transmission System Operators ('TSOs') which enables continuous cross-border trading across Europe. SIDC follows on from the Cross Border Intraday ('XBID') Project which delivered the first technical solution for creating SIDC through the intraday continuous trading platform in June 2018. SIDC allows energy networks to integrate and expand across Europe and was launched on 12/13 June 2018 across 14 countries and a year later the project parties announced a successful first year of operation. The following press releases illustrate these events in more detail.

The project responded to market needs by creating a transparent and more efficient continuous trading environment that allows market participants to easily trade their intraday positions across individual EU markets without the need for explicit transmission capacity allocation.

The technical solution works on a common IT system with:

- a Shared Order Book ('SOB'),

- a Capacity Management Module ('CMM'), and

- a Shipping Module ('SM').

This means that orders entered by market participants for continuous matching (supply meeting demand) in one country can be matched by orders submitted by market participants in any other country. They can be matched as long as they are within the project’s reach and transmission capacity is available.

The intraday solution supports continuous trading that is both implicit (capacity and energy together), and explicit (capacity only; note: only provided where requested by NRAs).

A public description of the continuous trading matching algorithm is available here: Public Description of the Continuous Trading Matching Algorithm.

Details of how SIDC – Continuous Intraday Market works can be found under this link. SIDC – Continuous Intraday Market is in line with the EU integrated intraday market target model set out in the CACM Regulation.

In cases where it is impossible to participate in the continuous intraday market within the SIDC, the market operator offers market participants the option of a backup local solution that matches bids exclusively within the Czech Republic.

SIDC geographical scope

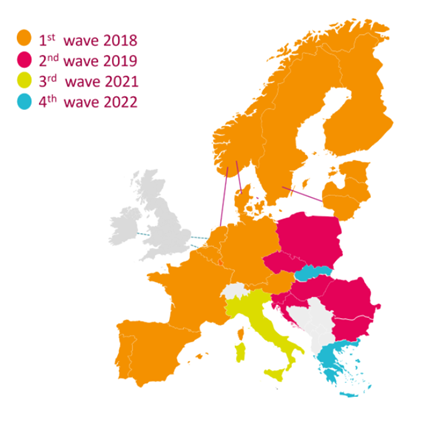

The continuous intraday market ('IM') within the SIDC expanded in phases/ waves. The first wave, launched in June 2018, included 14 countries.

On 19 and 20 November 2019, OTE, a. s., as the nominated electricity market operator in the Czech Republic, and ČEPS, a. s., as the transmission system operator in the Czech Republic, joined SIDC along with similar entities in six other European countries within the second wave go-live. This coupled 21 countries. The gradual expansion of the coupled continuous intraday market is illustrated in the following figure:

Figure 6 - Completed waves of SIDC enlargement (available on the NEMO Committee website here)

SIDC – Intraday Auctions (‘IDAs’)

Summary of all available information on intraday auctions is available in the presentation here.

Intraday auctions were introduced on June 13, 2024, as part of the single intraday electricity market in the EU, based on Decision No. 01/2019 on the approval of the Methodology for pricing intraday cross-zonal capacity by the Agency for the Cooperation of Energy Regulators (‘ACER’).

The intraday auction refers to an implicit intraday auction carried out within the single (intraday) European electricity market for the purpose of allocating available intraday transmission capacity using a market-coupling mechanism between individual bidding zones. It represents a trading platform for intraday auction trading that complements the existing intraday market.

The purpose of introducing intraday auctions is to harmonize the calculation and allocation of cross-border capacities on the intraday market and to price intraday cross-border capacities to reflect their shortage at a given time and thereby send an adequate price signal to the market.

The entities involved in the intraday auctions include Nominated Electricity Market Operators (‘NEMOs‘) and Transmission System Operators (‘TSOs’) who use XBID (Cross-border Intraday Coupling) technical solutions, PMB system (PCR Matcher and Broker) and Euphemia algorithm, new IDA CIP interface (Intraday Auction Central Interface Point) creating a connection between the auction algorithm and intraday trading algorithm, shipping systems and other regional systems.

The message formats used for intraday auctions are part of the documentation for the transition to the 15/min imbalance settlement period - can be found here.

The launch of intraday auctions from 13 June 2024 took place within the entire EU, as shown in the image below.

Figure 7 - Geographical scope of the introduction of intraday auctions from June 13, 2024

Organization of intraday auctions

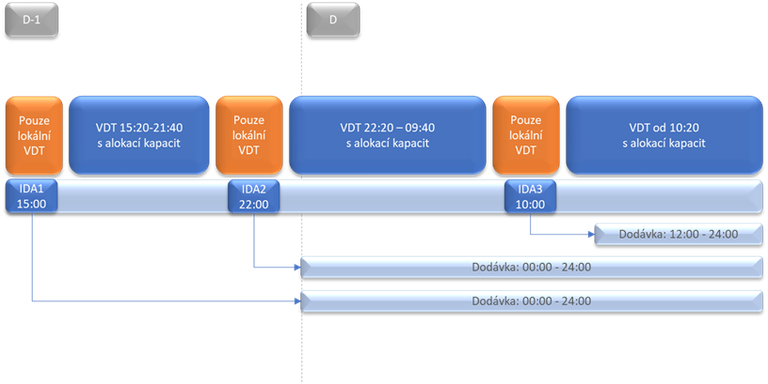

For the respective delivery day (hereinafter ‘D‘), 3 intraday auctions are held in the following time sequence:

- IDA1: D-1 15:00 for all D delivery hours

- IDA2: D-1 22:00 for all D delivery hours

- IDA3: D 10:00 for delivery hours 12:00-24:00 on D

A more detailed time schedule is shown in the following figure.

Figure 8 - Time chart of intraday auctions

Since the solution for the intraday auctions is based on the day-ahead market platform, the intraday auction includes similar processes as the day-ahead market only in shortened time intervals. Each intraday auction consists of 3 phases:

- Collection and submission of input data for IDA, the Pre-coupling

- The IDA calculation process up to the moment of validation of the results, the Coupling

- Submission and processing of IDA results and output data, the Post-coupling

Pre-coupling takes 20 minutes before the gate closure time, and coupling and post-coupling will cover 20 (in exceptional cases up to 30) minutes after the gate closure time. Within the intraday auctions, neither the full decoupling of markets nor a second auction is supported to speed up the process.

Implications for continuous trading

The possibility to trade on the continuous intraday market ('IM') with electricity is during the time when individual intraday auctions are organized (for IDA1 at 14:40 - 15:30, for IDA2 at 21:40 - 22:30 and for IDA3 at 9:40 a.m. – 10:30 a.m.) maintained, but cross-border capacities are not available within the continuous intraday market, and during this time orders are traded only within the given supply area (the Czech Republic).

Traded products

Intraday auctions were launched on Thursday, June 13, 2024, with only 60-minute products. (More information is available in the press release.) As of July 1, 2024, the Czech Republic switched to 15-min. settlement and trading period and from this date, it is possible to trade only products with 15-min. granularity. (More information on the transition to a 15-minute settlement period here.)

Supported intraday auction order types include Standard Order, Profile Block Order, Exclusive Profile Block Order Group, and Linked Profile Block Order. Other specific parameters of intraday auction trading are summarized here.